Who is calling or texting?

Start by searching for the number and get ready to see the available results!

Hint: Search ANY phone #, your significant other, or a mysterious caller...

Hint: Search ANY phone #, your significant other, or a mysterious caller...

Hint: Search ANY phone #, your significant other, or a mysterious caller...

Do you get a lot of spam calls or unknown callers on your cell phone? Should you answer it or let it roll over to voicemail? It's hard to know what to do if you don't know who’s calling. Fortunately, there are tools to help you find out and determine what to do next.

BeenVerified's Reverse Phone Lookup gives you the power to search billions of phone data points to try to find out who's behind those unknown calls. You might even uncover useful information about your caller, such as their address, age, email and social media profiles so you can decide whether to call the number back.

A reverse phone search works with all types of numbers, including cell phones and landlines, and with unpublished or unlisted numbers. Want to take the mystery out of your mystery caller? Our Reverse Phone Lookup can give you answers.

BeenVerified's Reverse Phone Lookup searches phone numbers and public records for information associated with the number. You might learn things about your unknown caller such as:

You can use a reverse phone search on both personal and business numbers to try to find details about who may be calling or texting you.

A reverse phone search report does more than just try to tell you the name of the person calling. BeenVerified has run more than 32 million reports for our customers for a variety of reasons, including the following scenarios:

As you can see, there are a lot of reasons to look up a phone number. Reverse number search tools can help protect you from scams as well.

A reverse phone search is a powerful tool that can help arm you against telemarketers, robocalls and phone scams.

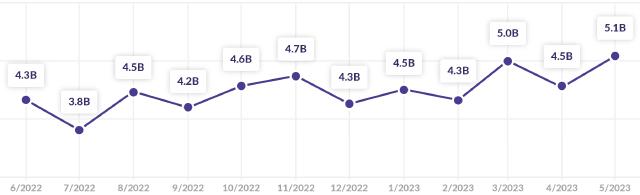

A Congressional Research Service report showed that robocalls, most of which are illegal, reached a record 4.1 billion in May 2018, a 41% increase from August 2017. That means each person in the US may receive an average of 13 robocalls per month. Some people are targeted even more frequently.

53.8B

Calls placed

147.9M

Per Day

6.1M

Per Hour

1.7K

Per Second

161

Avg. Calls Per Person

Fast forward to May 2023, and the number of robocalls is up to 5.1 billion! That means the average person in the US receives over 13 calls per month.

Source: YouMail Robocall Index

Remember, you should never give your personal information, account details or other sensitive intel to anyone who calls you. For example, if you get a call from your bank saying there’s a problem with your card or account, tell them you will call them back. Then dial the direct customer service number found on the back of your credit card or on the bank’s official website.

With robocalls and scams on the rise, there are always new ones to be on the lookout for. These usually involve you confirming personal details or giving the caller information to receive something of value. Others ask you to provide personal information to avoid getting into legal trouble.

Only give out your information to verified parties or organizations that you contact first (meaning you calling them). Never the other way around (them calling you).

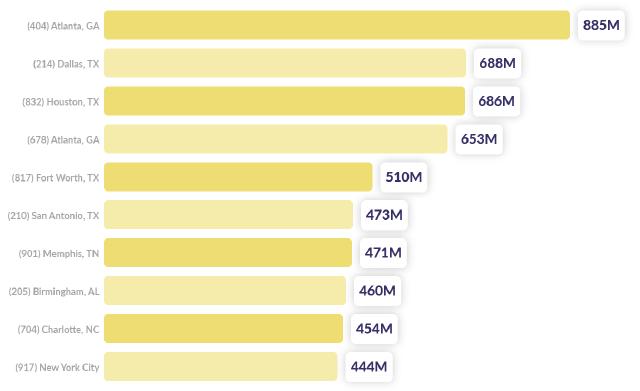

These are the cities that scammers, robocallers and telemarketers targeted the most in 2022:

BeenVerified searches through public records to try to help you identify a caller’s name and phone number. Get started with the following steps to run a reverse phone search:

Enter a phone number with the area code in the search box. Wait while we assess the potential owner’s name, location and related background information.

Running a reverse phone number search can provide you with information about the person or business that’s calling. BeenVerified’s Reverse Phone Lookup uses public records which can reveal things like the first and last name of the person calling, along with age, location, jobs, background, social media accounts and photos. Keep in mind that newly registered numbers are not always available.

Protecting your personal information starts with you. Unless you’re certain you know who you're talking to, keep your personal information private over the phone. Apply safe information practices. Let BeenVerified do the rest by helping you try to sniff out potential phone scammers.

There are a number of reasons why an incoming call may be displayed as “unknown.” These include situations where the number is unlisted or made through a VoIP service or app. When a number is unlisted, it means the person, company or organization is trying to keep their information private by intentionally removing it from directories like Whitepages and Yellow Pages.

With VoIP services, callers can request phone numbers through services like Google Voice which can display as “unknown caller” if there is no profile name on the digital voice account. Reverse phone searches can still be used to track down information about these numbers.

Need more help? Check out our help center!

Using a reverse phone lookup is the easiest way to see who called me from this phone number. The lookup matches the phone number with publicly available information about who may be calling including their first and last name, age and registered number location in a city or state.

A reverse phone lookup searches public records data for matches to the phone number that is calling you. Matched information can include name, age, street address, email, and social media profiles. A reverse phone search can be done on many types of numbers including cell phones and landlines with listed or unlisted numbers.

BeenVerified subscribers can lookup phone number records in seconds. The search will scan and analyze billions of records and potential number holder matches. Once the results are ready, you can view individual reports to see potential names, ages, street addresses, and other available information.

Reverse phone number searches are limited to public records and related data. For example, you won’t be able to see private network data like call logs, text messages, phone bills or other details about the phone number. All of this data is restricted to the phone carrier (like AT&T or Verizon) and is not publicly available.

There are a few ways a number can show up as an unknown caller including when the number is unlisted or made through a VoIP service or app. When a number is unlisted, it means the person, company or organization is trying to keep their information private by intentionally removing it from directory listings like Whitepages and Yellow Pages. When using VoIP services, the caller can request a phone number through services like Google Voice which can display as “unknown caller” if there is no profile name on the digital voice account. Reverse phone searches can still be used to track down information about these numbers.

Blocked numbers use *67 to hide their number on your phone’s caller ID. This may leave you without a number to look up using a reverse phone search. However, the number is still visible to your phone service provider. Try contacting your carrier to see if you can get the number from them. If you can locate the blocked number, use it to do a reverse number search.

BeenVerified is the go-to choice for everyday information.

Download now!