Unclaimed Money Search

Find out if some of it may belong to you or someone you know!

Hint: Search for potential unclaimed assets.

Hint: Search for potential unclaimed assets.

Usually when you hear the words "free money," more often than not, it's a scam. Unclaimed money, however, is legitimate, and some of it might be yours.

Government agencies and private businesses are holding nearly $60 billion in unclaimed cash—money that by all indications may rightly belong to someone who may not even know it exists.

Unclaimed money, sometimes called unclaimed property, comes in a variety of forms. It might be an uncollected tax refund, an abandoned checking account balance or a forgotten security deposit on a utility bill.

If you're owed unclaimed money, you should be legally entitled to it. You don't necessarily forfeit your right to collect it even 20 years later (depending upon the jurisdiction and applicable escheat laws). If you're the legal heir of someone with unclaimed assets, you may be able to claim the money on their behalf. Government agencies and corporations can't, in many circumstances, keep and spend the money just because you haven't claimed it yet.

Unfortunately, there's no "unclaimed money" website listing the money owed to private citizens. You have to look for it yourself, which can be tricky if you're not sure what you're looking for.

Start with your current state of residence and any state in which you've lived in the past. The National Association of Unclaimed Property Administrators maintains Unclaimed.org, a website where you can search for missing money on a state-by-state basis.

State agencies are a good place to start since most states have laws requiring banks and businesses to turn over their unclaimed property so that the government can search for the rightful owner. If you're owed a utility deposit or property tax rebate, it's likely held by the state.

However, many unclaimed assets aren't turned over to the state, so don't give up if a state search turns up empty. You may need to search other websites and databases to find your unclaimed cash.

Find People online, lookup contact info, phone numbers, emails and more!

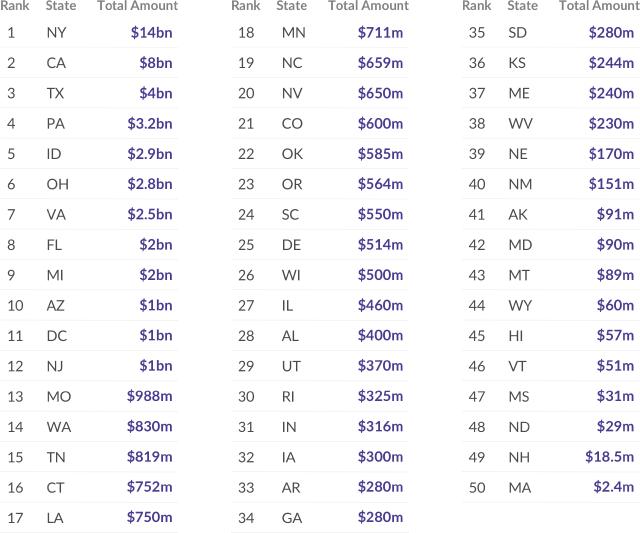

It's easy to imagine only the wealthy have unclaimed money to collect, but anyone could be owed missing cash. The state of New York has more than $14 billion in unclaimed property—that's around $700 for every resident of the state.

About half of all missing money claims involve $100 or less, but many people collect a lot more. The state of Texas returned $200 million in one year, with an average claim of $1,000.

Since most people aren't aware they're owed missing money, it never hurts to search. It can cost you nothing to collect your money, and filing a claim is usually as simple as completing an online form.

Source: Simple Thrifty Living

Find People online, lookup contact info, phone numbers, emails and more!

Each state agency and organization has its own system for processing claims. Some allow you to file online, while others require you to physically mail in your claim and supporting paperwork.

You may be asked to prove your identity when you submit a claim. If you're filing a claim on behalf of someone who has died, you'll need a certified copy of the death certificate and will, if there is one, or other estate documentation. When there is no will, the state requires other legal documents, such as affidavits and letters of administration.

The Better Business Bureau (BBB) warns consumers about the growing threat of unclaimed money scams. The fraudsters send you an email or postcard notifying you there's unclaimed money in your name. You're asked to supply personal information to confirm your identity and provide a debit or credit card number to cover postage and administrative fees.

Once you provide that information, the scammer has your personal and financial information to use for identity theft or to run up fraudulent charges on your accounts.

According to the BBB, legitimate organizations will never contact you in this way about unclaimed money. You should never pay a fee to collect unclaimed accounts, and you should never give your personal information over the phone or via email.

BeenVerified's Unclaimed Money Search combs publicly available databases to locate assets and accounts held in the name of its users. If you're owed any unclaimed money, BeenVerified can help locate the contact information for the appropriate agencies, so that you may file a claim. In some cases, you could obtain money in as little as two weeks, although some claims may take longer.

With BeenVerified, it costs you nothing additional to search for missing money—and you may learn all you need to file a claim. You don't necessarily have to provide any very detailed personal information, and you can be in control of the process from start to finish.

Governments, banks and businesses are holding billions in unclaimed money. Use BeenVerified's Unclaimed Money Search to try and see what portion, if any, might belong to you.